📌 Financial ratios are the backbone of financial analysis. They provide critical insights into a company’s performance, helping business owners, investors, and financial professionals make informed decisions.

Here are five critical categories of financial ratios you should know:

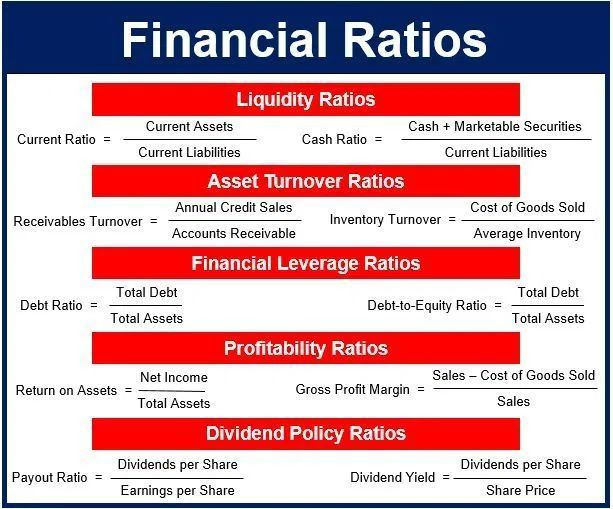

📌 Liquidity Ratios – Measure a company’s ability to meet short-term obligations.

➡️ Example: Current Ratio = Current Assets / Current Liabilities

(A ratio above 1 generally indicates a company can cover its short-term debts.)

📌 Asset Turnover Ratios – Assess how efficiently a company utilizes its assets to generate revenue.

➡️ Example: Total Asset Turnover = Net Sales / Average Total Assets

(A higher ratio suggests effective asset utilization.)

📌 Financial Leverage Ratios – Evaluate a company’s reliance on debt financing.

➡️ Example: Debt-to-Equity Ratio = Total Debt / Total Equity

(A high ratio may indicate higher financial risk.)

📌 Profitability Ratios – Show how well a company generates profit relative to its revenue, assets, or equity.

➡️ Example: Return on Equity (ROE) = Net Income / Shareholders’ Equity

(Indicates how efficiently shareholder funds are used to generate profits.)

📌 Dividend Policy Ratios – Reflect a company’s approach to distributing earnings to shareholders.

➡️ Example: Dividend Payout Ratio = Dividends Paid / Net Income

(A higher ratio means more earnings are distributed as dividends.)

Why should you care about financial ratios?

✅ They help in decision-making.

✅ They reveal financial strengths and weaknesses.

✅ They assist in benchmarking against competitors.

Mastering these ratios can elevate your financial literacy and improve business performance.

Which financial ratio do you find most insightful? Let’s discuss in the comments!